Dogecoin (DOGE) has been navigating a dynamic market landscape as of late May 2025, with its price oscillating around the $0.22 to $0.25 range. This period of consolidation follows a modest 0.84% dip on May 27, bringing the price to approximately $0.2246. Despite this slight correction, the meme-inspired cryptocurrency has demonstrated resilience, maintaining a steady position amidst broader market fluctuations.

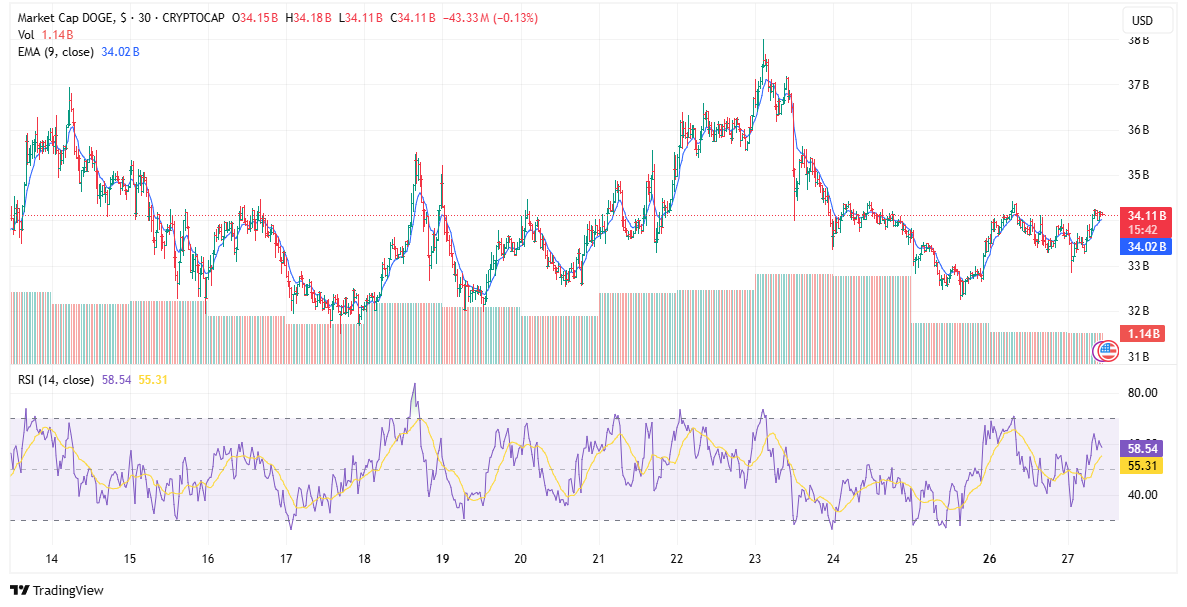

Technical indicators suggest a cautiously optimistic outlook for DOGE. The Relative Strength Index (RSI) hovers around 52.5, indicating neutral momentum without veering into overbought or oversold territories. Additionally, the 50-day moving average stands at $0.19, while the 200-day moving average is at $0.27, positioning the current price between these two key indicators. This alignment often signifies a potential for upward movement, provided market conditions remain favorable.

Source: Tradingview

On-chain metrics further bolster the case for a potential bullish trend. Recent data indicates a surge in whale activity, with significant accumulation by large holders. Specifically, addresses holding between 1 million to 10 million DOGE have increased their holdings, signaling confidence in the asset’s future performance. Moreover, DOGE’s Market Value to Realized Value (MVRV) ratio has dropped to -37%, suggesting that the asset is currently undervalued—a condition that has historically preceded significant price recoveries.

Analysts are closely watching the $0.25 resistance level, which has been tested multiple times in recent sessions. A decisive break above this threshold could pave the way for DOGE to target higher levels, with some projections aiming for $0.40 in the near term. However, it’s important to note that broader market factors, including upcoming economic data releases like the Core PCE print, could influence investor sentiment and, consequently, DOGE’s price trajectory.

While Dogecoin faces immediate resistance at the $0.25 mark, underlying technical and on-chain indicators suggest a foundation for potential growth. Investors and traders should monitor key support and resistance levels, as well as broader market cues, to navigate DOGE’s evolving landscape effectively.

Leave a Reply