The Token Generation Event That Went Wrong

XYZVerse’s highly anticipated token generation event in late January 2026 concluded with one of the most dramatic post-launch collapses witnessed in recent presale token history. The all-sport meme token, which raised funds across 15 presale stages with final pricing at $0.10, experienced a catastrophic price crash within days of its public trading debut. By February 1st, 2026, community members reported prices around $0.0002451, representing a staggering 99.75% decline from presale exit pricing.

The severity of the collapse shocked participants who had invested throughout the presale’s progressive pricing structure starting from $0.0001. Late-stage buyers who entered at $0.08-$0.10 faced devastating unrealized losses, while even early-stage participants struggled to exit positions profitably as liquidity evaporated under intense selling pressure. The launch dynamics validated concerns that many analysts had raised about the tokenomics structure, particularly the decision to unlock 55% of total supply simultaneously at TGE.

This analysis examines what actually transpired during XYZVerse’s token generation event, drawing from community discussions, on-chain data, and market performance metrics. Rather than evaluating the project based on presale marketing promises, we assess the actual launch execution and provide realistic recovery scenarios based on current market position. The lessons from XYZVerse’s TGE offer valuable insights for understanding the gap between tokenomics design on paper and real-world launch dynamics.

TGE Execution: What Actually Happened

Launch Timeline and Exchange Listings

XYZVerse completed its 15-stage presale in late January 2026 and proceeded directly to token generation event as documented in the project roadmap. The TGE delivered all presale allocations simultaneously with 100% immediate unlock, meaning every participant who purchased across the entire presale period received full liquidity at the same moment. This design choice, marketed as “investor-friendly” during presale, created the structural foundation for the subsequent price collapse.

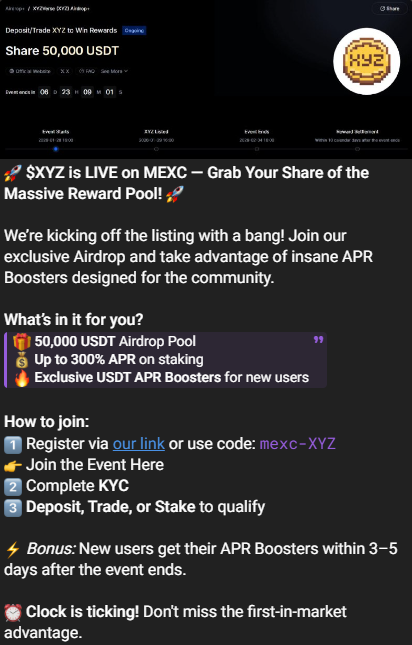

The token launched on PancakeSwap (BSC network) for decentralized trading and MEXC for centralized exchange access, fulfilling the promised listing strategy. However, the liquidity deployment that was supposed to support price stability proved catastrophically insufficient. While the team had committed 40% of presale proceeds to DEX liquidity with a 24-month lock, this capital couldn’t absorb the selling tsunami from billions of presale tokens hitting the market simultaneously.

The Price Collapse: Hour by Hour

Within the first days of trading, XYZ experienced one of the most severe post-launch crashes in recent presale token history. The price trajectory revealed the exact dynamics that tokenomics analysts warn about when designing unlock schedules.

Price Action Timeline:

- Launch (Late January 2026):Initial trading near $0.08-$0.10 range

- First Hours:Rapid decline as early presale participants exit

- First 24-48 Hours:Acceleration of selling as panic spreads

- February 1st, 2026:Community reports prices at $0.0002451

The collapse followed predictable patterns. Initial sellers who acted within minutes of TGE captured prices closest to presale levels, executing exits between $0.05-$0.10. As word spread about falling prices, a rush for exits overwhelmed available buy-side liquidity. Each wave of selling pushed prices lower, triggering stop-losses and panic sales from holders who watched their positions evaporate in real-time.

Community discussions from the official Telegram channel captured the chaos. One participant noted: “Only a few managed to sell before price fall,” while another predicted the post-crash dynamics: “Some one will use this as a secondary pump and dump now…. seen it with so many pre sales.. it tanks next to nothing, some one scoops up millions or billions cheep, pumps it for 2 or 3 weeks and then dumps in like 20 min, rinse and repeat til dead dead.”

Technical Issues Compound the Crisis

Technical execution problems during the claim process added to negative sentiment during the critical launch period. Multiple users reported issues with the token claim interface, creating confusion about whether tokens had been properly distributed. Telegram messages from February 4th showed users asking “Can someone help me and tell me why the claim button isn’t clickable?” with responses confirming “you have already received your tokens” but without clear explanation of the automated airdrop process.

These technical gaps, while not directly causing the price crash, contributed to the perception of poor launch execution. When prices are already collapsing, any additional friction or confusion compounds investor frustration and accelerates community trust erosion.

Supply Data Discrepancy Crisis

An additional complication emerged when community members began comparing on-chain data with information displayed on major cryptocurrency tracking platforms. A user who conducted detailed verification discovered alarming discrepancies:

Supply Reporting Confusion:

- CoinMarketCap:Showed 92 billion maximum supply

- CoinGecko:Displayed 67.92 billion maximum supply

- On-Chain Reality:Blockchain scanner confirmed 11,522,777,000 (11.52 billion) actual total supply

This 8x-10x discrepancy in reported supply creates massive confusion for potential investors trying to evaluate market capitalization and fair value. The explanation appears to involve burned tokens from extended supply that major aggregators haven’t updated in their databases. While the on-chain reality of 11.52 billion represents the accurate figure, platforms continuing to display inflated numbers affect price discovery and make comparative analysis against other tokens nearly impossible.

As one community member explained: “This creates a misleading impression of the project’s tokenomics and may misinform users about the actual market capitalization and growth potential.” The team’s failure to coordinate proper supply reporting with major aggregators before TGE represents another execution gap that undermines confidence.

Community Response and Sentiment Shift

The Telegram community shifted from presale optimism to post-crash reality within days. Messages captured the emotional trajectory from disbelief to anger to resignation.

Representative Community Sentiment:

The community discussions revealed several recurring themes. First, acknowledgment that only quick sellers captured reasonable prices while the majority got caught in the collapse. Second, predictions about potential pump-and-dump manipulation now that prices crashed to near-zero. Third, questions about whether recovery remains possible given the shattered trust and departed community members.

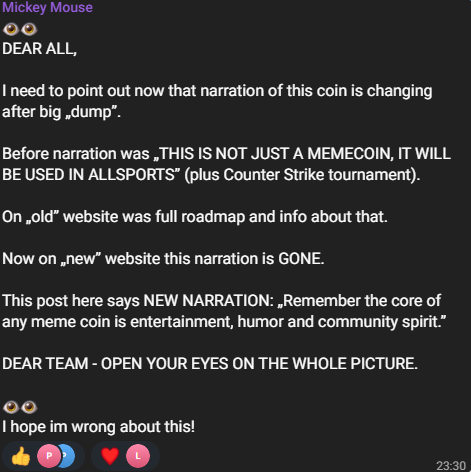

Participants observed that the project’s narrative shifted from “THIS IS NOT JUST A MEMECOIN, IT WILL BE USED IN ALLSPORTS” with detailed roadmaps and Counter Strike tournament plans to a simplified “entertainment, humor and community spirit” memecoin positioning. The alleged removal of utility promises from the website after the crash, if accurate, represents a significant retreat from what presale investors originally purchased.

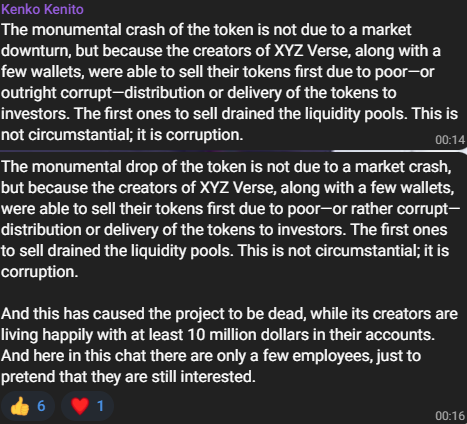

More serious allegations involve the distribution mechanics themselves, with community members claiming that creators and select wallets were able to sell tokens first due to corrupt distribution timing, draining liquidity pools before most investors could access their tokens. Some participants estimated that creators profited approximately $10 million while leaving remaining community members with worthless holdings, suggesting only minimal staff remain “just to pretend that they are still interested.” While these allegations of selective token distribution favoring insiders remain unverified through comprehensive on-chain analysis, the technical claim issues documented in Telegram discussions suggest genuine execution problems during launch, whether intentional or incompetent.

Some holders adopted a “buy and hold” mentality despite losses, posting messages like “BUYYYYY AND HODLLLLLLL” with chart emojis. However, these attempts to rally sentiment appeared increasingly hollow against the backdrop of 99%+ losses. Others simply stopped participating, with the steady decline in active Telegram users indicating capitulation and abandonment.

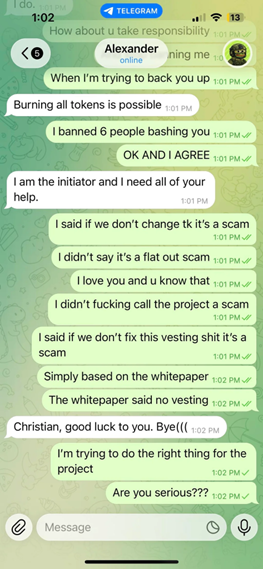

Beyond price collapse frustrations, more serious allegations emerged on social platforms. A Reddit post titled “Be aware that XYZVerse is a scam!!” appeared in the r/xyzverse subreddit, making explosive claims about team intentions and internal dynamics.

The post, allegedly from a former moderator, stated: “The owner has openly admitted that he’s going to rug pull. I got demoted from moderator and banned from the chat because I refused to support his scamming tactics. I stuck up for the community whom was irate about vesting because it was said from day 1 the project wouldn’t have vesting. Since I did this, I was banned and removed from the chat because I’m not going along with rug pulling like he wants me to!!” (Reddit r/xyzverse)

By early February 2026, the community that remained consisted primarily of three groups: those too deep in losses to sell, speculators hoping for pump-and-dump opportunities, and a small core of believers still trusting the utility roadmap promises. The once-engaged presale community had largely evaporated, taking with it the social proof and momentum that new tokens require for recovery.

XYZ Price Prediction: 2025-2030 Analysis

Price predictions for early-stage cryptocurrencies involve substantial uncertainty, but examining potential scenarios based on market dynamics, adoption trajectories, and comparable projects provides useful framework for consideration. These projections assume successful platform delivery and sustained community engagement while acknowledging that actual outcomes may vary significantly.

Price Prediction Overview Table

| Year | Conservative | Realistic | Bullish | Key Assumptions |

|---|---|---|---|---|

| 2025 | $0.08 – $0.12 | $0.12 – $0.25 | $0.40 – $0.50 | Successful TGE, 2–3 CEX listings, basic platform delivery |

| 2026 | $0.15 – $0.30 | $0.30 – $0.60 | $0.80 – $1.20 | Functional prediction markets, 50K+ holders, sports partnerships |

| 2027 | $0.25 – $0.50 | $0.60 – $1.00 | $1.50 – $2.50 | 100K+ active users, tier-1 exchange listings, revenue generation |

| 2028 | $0.40 – $0.80 | $0.80 – $1.50 | $2.00 – $3.50 | Established platform, multiple partnerships, mainstream recognition |

| 2029 | $0.50 – $1.00 | $1.00 – $2.00 | $2.50 – $4.00 | Mature ecosystem, sustained user growth, competitive positioning |

| 2030 | $0.60 – $1.20 | $1.20 – $2.50 | $3.00 – $5.00 | Market leadership in sports crypto, long-term sustainability |

Risk Factors and Considerations

Balanced analysis requires acknowledging inherent risks alongside potential opportunities. Understanding these factors helps investors make informed decisions about participation in the XYZVerse presale and holding strategy post-launch.

Primary Risk Considerations:

- Immediate Token Unlock at TGE:All presale tokens become liquid simultaneously, creating potential selling pressure if significant portions of early investors choose profit-taking over long-term holding. This design respects investor freedom but introduces volatility risk during critical early trading periods.

- Anonymous Team Structure:While common in meme coin sectors, the absence of identified team members limits accountability mechanisms and recourse options if development falters or conflicts arise. Projects with doxxed teams offer clearer responsibility chains and reputation stakes.

- Utility Platform in Development:Promises of prediction markets, betting integrations, and entertainment features exist as roadmap items rather than functional products. Crypto history contains numerous projects with impressive roadmaps that failed to deliver actual utility.

- Intense Market Competition:The meme coin sector experiences constant new launches competing for limited attention and capital. Sports tokens face competition from both crypto-native alternatives and traditional sports betting platforms that may integrate blockchain features.

- Regulatory Uncertainties:Sports betting integrations face complex legal landscapes varying by jurisdiction. XYZVerse’s planned features may encounter restrictions in certain markets, limiting addressable user base or requiring significant compliance investments.

- High Volatility Characteristics:The meme coin sector generally exhibits extreme price swings, with projects experiencing rapid appreciation followed by equally dramatic corrections as speculative interest shifts between trending tokens.

These risk factors don’t necessarily indicate project failure, but represent considerations that each investor must evaluate according to personal risk tolerance and investment philosophy. Projects successfully navigating these challenges can achieve sustainable growth, while those that stumble often see rapid value deterioration.

Positive Indicators and Strengths

Fair assessment also recognizes project strengths and positive structural elements that distinguish XYZVerse from lower-quality presale offerings. These factors contribute to the project’s potential for successful execution and long-term sustainability.

Key Strengths and Positive Signals:

- Transparent Tokenomics Documentation:Clear allocation percentages, vesting schedules, and release timelines allow informed decision-making compared to projects offering vague or contradictory information about token distribution.

- 24-Month Liquidity Lock:Demonstrates meaningful commitment to project longevity rather than quick exit strategies. This structural safeguard addresses one of the most common concerns in new token launches.

- Active Community Engagement:The project maintains consistent communication through social channels, responds to community questions, and conducts regular updates. This engagement pattern correlates with more sustainable projects compared to those going silent after launch.

- Multi-Stage Presale Structure:Allows price discovery during the presale itself rather than creating single-price entry followed by immediate public trading. The progressive pricing rewards earlier supporters while providing multiple entry opportunities.

- Clear Utility Roadmap:Unlike pure speculation tokens, XYZVerse outlines specific platform features including prediction markets, betting integrations, and entertainment ecosystem that could drive actual usage demand.

- Low Barrier to Entry:Accepts multiple payment methods including ETH, BNB, USDT, and card payments without minimum investment requirements, maximizing accessibility for diverse investor base.

These positive elements don’t guarantee success but establish a foundation that separates XYZVerse from obvious low-effort projects. The combination of structural safeguards, community focus, and utility ambitions creates potential pathways to sustainable value creation if execution meets planning.

Final Assessment

XYZVerse is a structured meme-utility presale project at the intersection of sports, esports, and crypto. It features clear tokenomics with tiered pricing favoring early buyers, significant token burns (≈17%), and allocations for liquidity, development, and community rewards. The ambitious roadmap includes a multi-title esports platform, play-to-earn mechanics, decentralized betting, and real-world sports fan engagement. The key question is whether the team can execute this vision and create sustainable value beyond initial hype.

The anonymous team and immediate token unlocks carry risks that investors must weigh against their own tolerance. If the platform delivers, community grows, and market conditions remain favorable, realistic price scenarios point to $0.12–$0.25 by late 2025, $0.30–$0.60 through 2026, and potentially $0.50–$2.00 by 2030. As with any crypto presale, thorough independent research is essential—invest only what you can afford to lose completely.

This article provides informational analysis and should not be construed as financial advice. Cryptocurrency investments carry substantial risk including potential total loss of invested capital. Readers should conduct thorough independent research and consult financial advisors before making investment decisions.

Leave a Reply